Affordable and Quality Tax Preparation

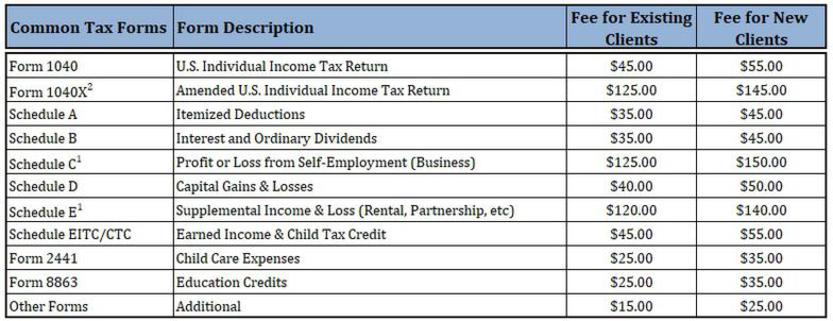

We understand how time-consuming and complicated preparing your taxes can be, and when you think you are all done, you may be left with more questions than answers. Some overlook deductions and credits to which they're entitled, and others claim deductions they aren't entitled to. Either way, we are here to handle your tax preparation needs. With tax clients in Washington, D.C., Maryland, Virginia, and throughout the rest of the country, we are a firm ready and willing to go the extra mile for you. We've assisted more than 2,000 individuals and small businesses with financial and tax services since our 2010 inception and processed more than $10.0 million in federal and state tax refunds for clients. The lowest fee to prepare a new client's tax return is $82.50 for single individuals and $161.50 for married couples filing jointly. To get started, please see the links under Available Tax Resource Forms.

IMPORTANT NOTES:

For other forms/schedules (i.e. S & C Corps, 990's & Partnerships), please email or call/text 202-841-4713 for the price

If Married filing Jointly, a fee of $75 will be added to 1040 form

Each State Preparation is 50% of 1040 form

1. Assumes annual revenues below $50K and that client will provide financial documents; if greater than $50K and/or financial documents aren't available, please contact for pricing

2. New clients will pay for original tax prep fee + the amended fee, existing clients only need to pay amended fee shown

Please note, the IRS does not endorse any particular individual tax return preparer.

Available Tax Resource Forms

Our Fee Schedule

Last Updated: December 2018

We have a NO REFUND POLICY: This No Refund Policy applies to payments for tax prep services rendered on an preparer-client basis for tax services. You understand that once we provide services to you our fees are Non-Refundable. Fees are not dependent upon results and no specific legal outcome may be promised.